Indian Wines Going from Strength to Strength

27. Juli 2016picture above: Krishna Prasad and Uma Chigurupati, producers of international award winning KRSMA wines, pictured outside their winery in the Hampi Hills of north Karnataka, India

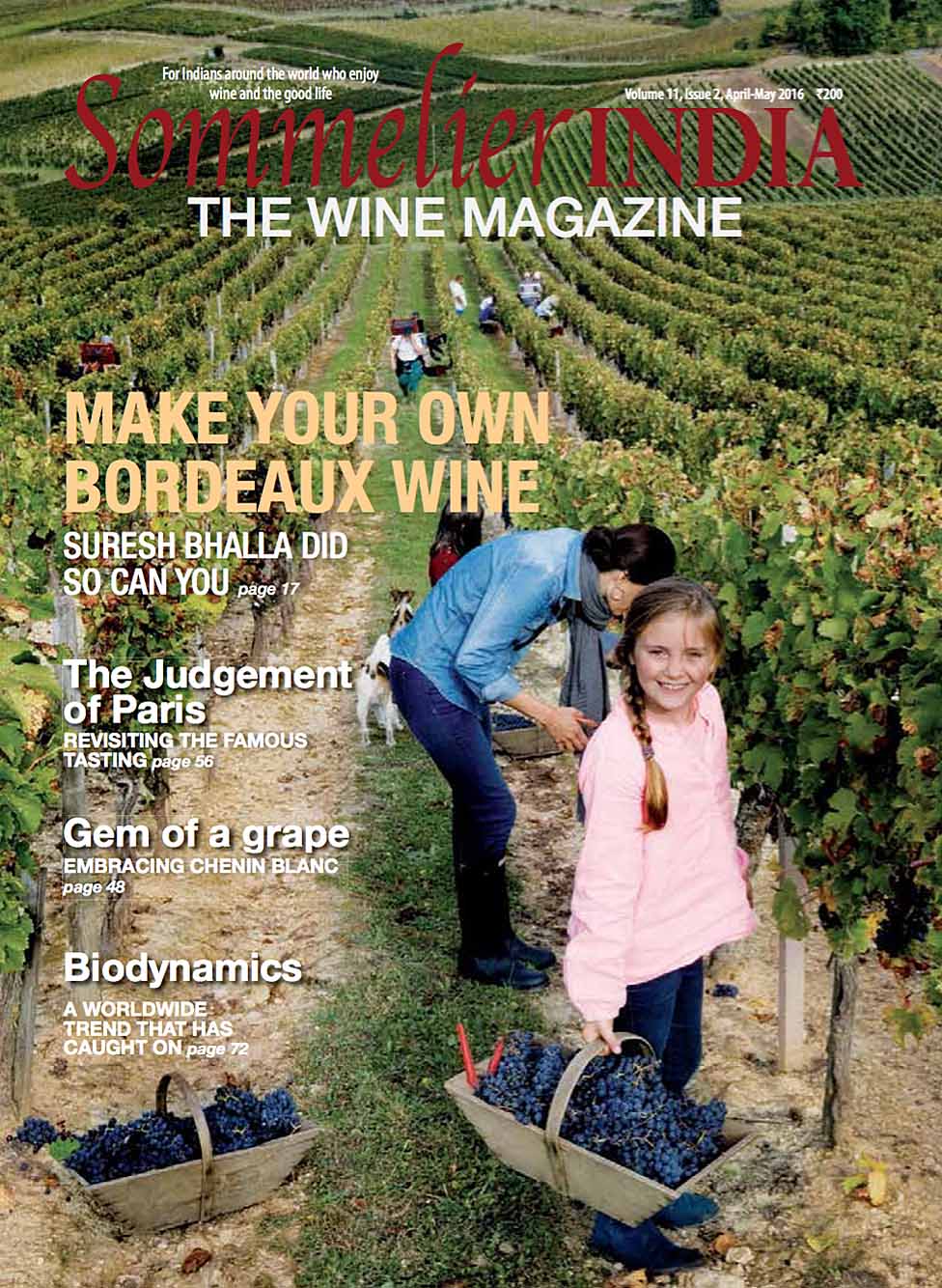

reprint from Sommelier India - India`s Premier Wine Magazine

Looking back, Alok Chandra offers an overview of the Indian wine industry which is staying the course despite various roadblocks

It is something of an aphorism that the wine industry in India occupies much more “mindspace†than is warranted by the actual size of the business which is tiny – around three million cases in 2013/14 compared to over 200 million cases in China. In consumption, even countries like Kazakhstan, Ghana, and The Ivory Coast overtake us! What's worse, half of that low figure for India is made up of about 1.5 million cases of port-style wines produced from table grapes, which purists would not count as wine. However, priced between `50 and `200 per bottle at retail, this has been the fastest-growing Indian segment for some years.

Bear in mind, too, that wine has to compete for listings or shelf space and “share of throat†with the much larger businesses of spirits (300 million cases) and beer (265 million cases), neither of which sit quietly and allow wines to encroach on their turf with impunity.

Nevertheless, wine sales in India do continue to grow – at 15% to 20% annually, driven by changes in lifestyles and spending habits from consumption by women as well as visitors from overseas and, of course, also due to the increasingly better quality of some of the wines made in India.

This is a key trend. The fact that some Indian wines have managed to equal the price-and-quality status of imported wines despite the high customs duties on wines, which amounts to 162% in India. While entry-level imported wines start at around Rs 1,000 per bottle, today there are at least a dozen reserve Indian wines priced between `800 to `1,700 – a far cry from just seven years ago when no Indian wines were priced over `500 per bottle.

More importantly, the quality of Indian wines is improving all the time as wineries follow best practices, with due attention paid to grape quality, winemaking and international standards of packaging. This is particularly true of new entrants like KRSMA, Alpine Wineries and SDU from Karnataka, and Fratelli, Charosa, Vallonné and Chandon from Maharashtra – aptly demonstrated in a recent tasting of in Mumbai where top honours were shared equally by industry leaders Sula, Grover Zampa, Nine Hills, and the new wineries mentioned above.

So what is the current state of the Indian wine industry? While Sula remains the big gorilla with over 50% share of the domestic premium wine market, numerous smaller players have emerged to nibble at (but not seriously challenge) its monopoly. That said, only 47 of the 79 wineries in Maharashtra are still in operation and of these only 10 are selling outside the state. In Karnataka, the situation is a little better, with 17 out of 22 wineries still operating, although only Grover Zampa and Heritage are as selling wine outside the state.

The reality is that apart from Sula almost everybody else is still in an invest-grow mode or, in other words, still in the red. Not that Sula is making a great deal of money. In 2011/12 their profit after tax was a modest nine per cent on a revenue of `145 crore, with a substantial portion of their bottom line coming from wine tourism. Two significant wineries have launched their wines in the past year. KRSMA Estates in north Karnataka (near Hampi), and Charosa Vineyards located at Dindori, near Nashik. Both properties produce estate-grown wines and have done everything by the rule book. Inded, they have already made a mark at the top end of the quality spectrum for Indian wines. What's more, recent entrant Fratelli Wines is distributing its wines across India and has expanded into the sale of imported wines.

Thirdly, Grover Vineyards merged with Vallée du Vin to form Grover Zampa Vineyards. The initiative seems to be working as they have revamped both their wine quality and management and are regaining the consumer confidence lost in recent years.

Finally, Moët Hennessey India launched Chandon Brut and Brut Rosé wines produced in India at attractive price points. Distinctive and high quality wines, they will challenge Sula's pre-eminence in the domestic sparkling wine category, and have raised India's profile as a wine producer in the international arena. As for importers, their “cup of woe runneth overâ€. The Food Safety & Standards Authority of India (FSSAI) has become yet another regulatory body with standards to satisfy. New mandatory declarations on labels and testing criteria will result in at least 20% of imported wines disappearing from the market, as well as delays and shortages in the key year-end festive season of 2014.

However, a shakeout in the import space was long overdue – as the saying goes, “What doesn't kill you will only make you strongerâ€. So in the short term only the more serious players will be left in the playing field. However, in the longer term the FSSAI constraints are likely to inhibit the entry of new wines, as well as limit – and make more expensive – those that continue to be available in the country. This is not good from the consumer's point of view. As for recent innovations in the industry, the only apparent change is the emergence of quality-consciousness. Wine labels now state their vintages, as well as (in some cases) details of the grape varieties used. Wine tasting competitions are starting to rank Indian wines and inform consumers of their rankings.

There were few technical advances in production. Clonal selection practices are still rare. Nobody has adopted mechanical viticulture as the scale of vineyards is generally too small for this to make financial sense. In winemaking, only two wineries are using open-topped fermenters for their reds (KRSMA and Charosa), while a few more are using barrel fermentation and cask maturation for reserve wines. There have been no innovations in wine packaging, apart from a magnum Cabernet Sauvignon from KRSMA. (Sula already has a Brut in magnum). This could be due to inflexible state excise rules that inhibit items like the Bag-in- Box (BIB) offerings, which are so common overseas.

What are the prospects for the industry in the near future? Optimistic, for the most part. Volumes are likely to continue growing at 15% to 20% annually, due to both organic growth and pipeline filling in new markets, and the quality of Indian wines will continue to improve. While no new wineries are coming up, some units lying closed may be revived to produce on contract for local markets, using table grapes (for fortified wines), fruit, and even dates, particularly in the north east states of Arunachal and Meghalaya where a new wine policy may be in the offing. More important is the impact of the Modi government on the economy and consequently on disposable income, which will partly translate into higher spending on lifestyle products like wine. While Gujarat is unlikely to repeal prohibition any time soon, there are unlikely to be any significant new taxes on wine, either at the centre or in the states. With luck, there could be a change in customs duties on imported wines in the next budget, which may be rationalised back to the three- slab system that existed till about 2006 – thereby continuing to protect the domestic industry from cheap imports while making better (and higher-priced) wines more affordable. Let's raise a (wine) glass to the wine industry in India – growing by leaps and bounds!